Arguably the most prominent desi power couple in the world right now, British government's Chancellor of the Exchequer Rishi Sunak and businessperson Akshata Murthy are in the spotlight – but not for the right reasons.

It was revealed earlier this week that Akshata Murthy, Sunak's wife, holds a non-domiciled (non-dom hereafter) status in the country.

Murthy is the daughter of Indian billionaire businessperson NR Narayana Murthy, who is the founder of Infosys, one of India's largest IT companies.

She reportedly pays £30,000 a year to maintain her non-dom status, which allows her to avoid paying up to £20 million in tax to the British government.

The revelation has stirred up a controversy, given that the chancellor recently raised the tax amount for millions of British people.

In this explainer, we try to understand what a non-dom status means, why it is creating such a row for Sunak and Murthy, and why it doesn't reflect well on the chancellor, and the Boris Johnson-led British government.

Akshata Murthy's Non-Dom Status and How it Might Harm Rishi Sunak Politically

1. What Does a Non-Domiciled Status Mean?

"Domicile" in jurisprudence refers to the country that a person considers their permanent home.

If a UK resident attains a non-dom status with Her Majesty's Revenue and Customs (HMRC) department, it means that they do not consider the UK to be their permanent home, and can therefore avoid paying regular taxes to the British government on foreign earnings.

Foreign earnings also include company stocks (relevant in Murthy's case). Tax, however, has to be paid if the money earned abroad is deposited into a UK bank account.

Attaining a non-dom status is not an automatic development. One has to apply for it under certain conditions.

For example, those living in the UK for a minimum of seven of the last nine tax years must pay £30,000 a year to the British government to maintain their non-dom status (these numbers correspond to Murthy's case).

That amount doubles to £60,000 a year if they have been living in the UK for 12 of the last 14 tax years.

This law is undoubtedly controversial because it is said to benefit only the ultra-rich.

One study concluded that around 40 percent of those who had earned £5 million or more in 2018 had claimed non-dom status at some point in the last 20 years.

Actually, that study, conducted by the London School of Economics and the University of Warwick, also stated that "one in seven non-doms are from India."

The status does not last after people have been UK tax residents for 15 of their last 20 years. Then they have to pay tax to the British government on foreign earnings as well.

Expand2. The Controversy Around Akshata Murthy

Akshata Murthy has reportedly claimed a non-domiciled status, which permits her to not pay tax from her earnings made outside of the United Kingdom.

But where do the said earnings come from?

Murthy owns a 0.93 percent stake in Infosys. As of April 2022, the company has a market capitalisation (the company's share price multiplied by the number of shares outstanding) of approximately $100 billion.

Owning a 0.93 percent stake in a company worth around $100 billion means her foreign earnings amount to many millions of dollars or even pounds.

As already mentioned above, according to one report, Murthy avoids paying up to £20 million in tax because her non-dom status makes it legal for her to not pay the 39.35 percent tax applied to dividend payouts for resident taxpayers in the UK's highest income tax bracket.

According to an estimate by The Guardian, Murthy has collected £54.5 million in dividends from Infosys since 2015 (11.5 million pounds in annual dividends).

So, 39.35 percent of 54.5 million equals to around 20 million, which is the amount of money (in pounds) she has saved from losing as tax money.

Murthy's spokesperson, in response to the controversy, has stated that she has abided by all the tax laws that apply to her as a UK resident.

"Akshata Murthy is a citizen of India, the country of her birth and parents' home. India does not allow its citizens to hold the citizenship of another country simultaneously. So, according to British law, Ms Murthy is treated as non-domiciled for UK tax purposes. She has always and will continue to pay UK taxes on all her UK income."

Spokesperson for Akshata MurthyExpand3. By Extension, the Controversy Around Rishi Sunak

If the whole outcry is regarding his wife using the UK's non-dom law to her advantage, where does Rishi Sunak fit in?

Well, Sunak has been criticised for being responsible for the high taxes that the British people have been paying (taxes are going to get higher).

This has happened in the backdrop of a serious cost-of-living crisis, and widening economic inequality in British society.

The Chancellor of the Exchequer has passionately defended his wife.

"To smear my wife to get at me is awful. She loves her country like I love mine," Sunak asserted in response to accusations regarding hypocrisy and tax avoidance.

Now there are two issues here. Both are exemplified by the concerns voiced by members of Sunak's own party, the Conservative Party, as reported by The Guardian:

"There's this guy, as rich as Croesus, putting up taxes when people are worrying about the next gas bill."

Anonymous Conservative MP"The perception is [an attitude of] 'what is the problem?' Here is someone worth £3 billion who has a different tax arrangement. I’m sure everything is above board but that’s not the point."

Anonymous Conservative MPEven if Murthy is not breaking any tax laws (and there is no evidence for the same at the moment), one problem that Sunak faces is that he has been raising taxes for ordinary British people.

So on one hand, commoners pay more tax, but his millionaire wife avoids paying millions in tax.

So, the second issue concerns the system, a system which has one rule for commoners, and another for the elite.

To add to that, tax experts, when asked about the current row, have clearly stated that Murthy's non-dom status is a product of her choice, not anyone's coercion.

Richard Murphy, a professor of accounting at Sheffield University management school and tax justice campaigner, confirmed the same to The Guardian.

"In that case the implication in Ms Murty’s statement that she has to be treated as non-domiciled is simply wrong. She is only non-domiciled because she asked to be so."

Expand4. Labour Turns up the Heat

The party in Opposition, the Labour Party, has come out all guns blazing.

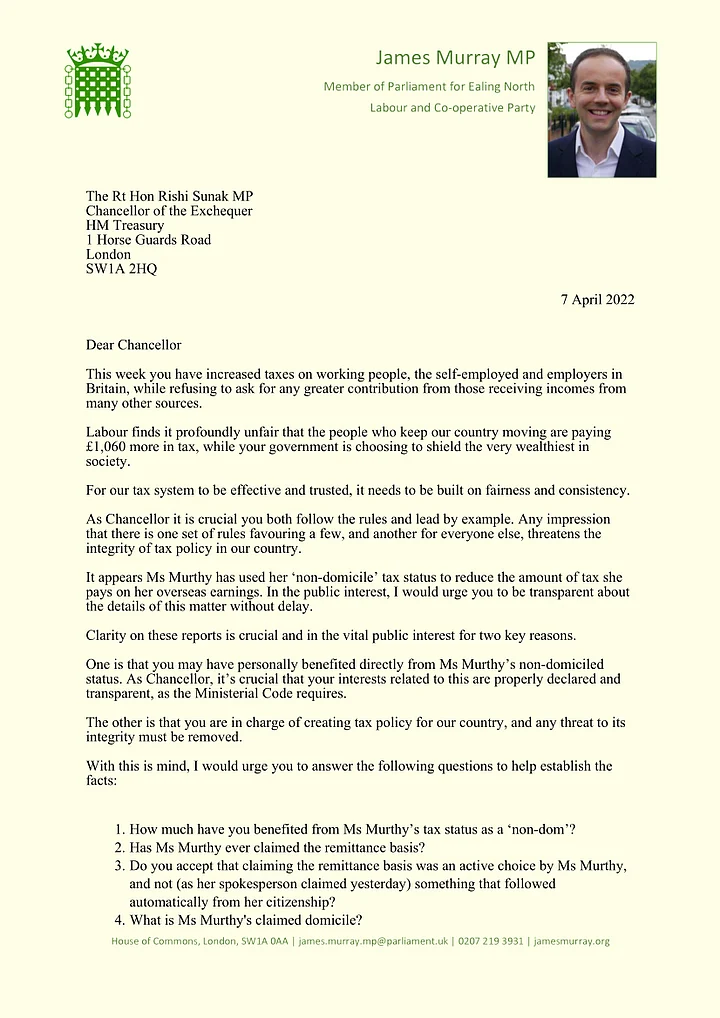

The shadow financial secretary to the Treasury, citing the "integrity of tax policy," has argued that it is "in the vital public interest" that Sunak provide clarity on whether he himself has benefited from his wife's non-dom status.

"As chancellor it is crucial you both follow the rules and lead by example. Any impression that there is one set of rules favouring a few, and another for everyone else, threatens the integrity of tax policy in our country," James Murray said, as reported by the BBC.

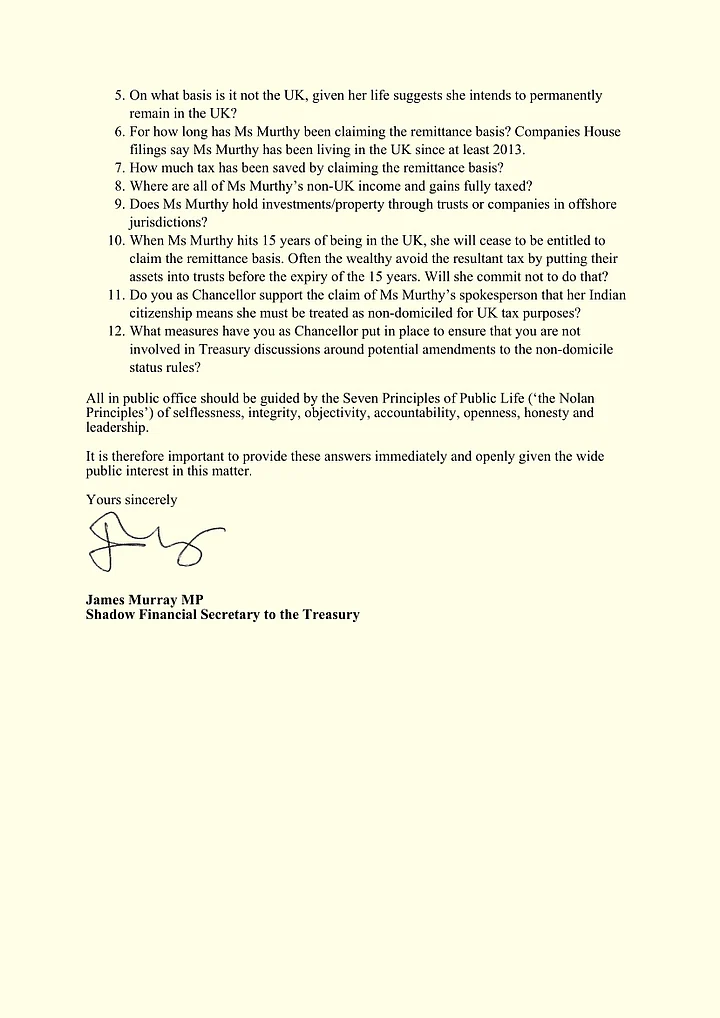

He also wrote a letter to Sunak (attached in the slideshow below), asking him 12 questions regarding the controversy.

Leader of the Labour Party and Leader of the Opposition Sir Keir Starmer has also spoken out, claiming that Sunak will have "very serious questions to answer".

"If it now transpires that his wife has used schemes to reduce her tax, while he's been increasing taxes on working people, that's breathtaking hypocrisy," he said, reported the BBC.

Since the revelations, Starmer has also been tweeting ferociously about the economic crisis in the country.

Additionally, the Liberal Democrats have urged Sunak to ensure that partners of ministers are barred from attaining non-dom status.

Sunak, however, may find some respite in what Business Secretary Kwasi Kwarteng has said while defending him and Murthy.

Kwarteng said it was "completely unfair" to criticise the tax practices of Murthy, "who is not a politician" and rejected claims made by the opposition that she is being sheltered by the Tory government.

Nevertheless, Sunak should expect a barrage of questions directed at him during next week's PMQs.

(At The Quint, we question everything. Play an active role in shaping our journalism by becoming a member today.)

Expand

What Does a Non-Domiciled Status Mean?

"Domicile" in jurisprudence refers to the country that a person considers their permanent home.

If a UK resident attains a non-dom status with Her Majesty's Revenue and Customs (HMRC) department, it means that they do not consider the UK to be their permanent home, and can therefore avoid paying regular taxes to the British government on foreign earnings.

Foreign earnings also include company stocks (relevant in Murthy's case). Tax, however, has to be paid if the money earned abroad is deposited into a UK bank account.

Attaining a non-dom status is not an automatic development. One has to apply for it under certain conditions.

For example, those living in the UK for a minimum of seven of the last nine tax years must pay £30,000 a year to the British government to maintain their non-dom status (these numbers correspond to Murthy's case).

That amount doubles to £60,000 a year if they have been living in the UK for 12 of the last 14 tax years.

This law is undoubtedly controversial because it is said to benefit only the ultra-rich.

One study concluded that around 40 percent of those who had earned £5 million or more in 2018 had claimed non-dom status at some point in the last 20 years.

Actually, that study, conducted by the London School of Economics and the University of Warwick, also stated that "one in seven non-doms are from India."

The status does not last after people have been UK tax residents for 15 of their last 20 years. Then they have to pay tax to the British government on foreign earnings as well.

The Controversy Around Akshata Murthy

Akshata Murthy has reportedly claimed a non-domiciled status, which permits her to not pay tax from her earnings made outside of the United Kingdom.

But where do the said earnings come from?

Murthy owns a 0.93 percent stake in Infosys. As of April 2022, the company has a market capitalisation (the company's share price multiplied by the number of shares outstanding) of approximately $100 billion.

Owning a 0.93 percent stake in a company worth around $100 billion means her foreign earnings amount to many millions of dollars or even pounds.

As already mentioned above, according to one report, Murthy avoids paying up to £20 million in tax because her non-dom status makes it legal for her to not pay the 39.35 percent tax applied to dividend payouts for resident taxpayers in the UK's highest income tax bracket.

According to an estimate by The Guardian, Murthy has collected £54.5 million in dividends from Infosys since 2015 (11.5 million pounds in annual dividends).

So, 39.35 percent of 54.5 million equals to around 20 million, which is the amount of money (in pounds) she has saved from losing as tax money.

Murthy's spokesperson, in response to the controversy, has stated that she has abided by all the tax laws that apply to her as a UK resident.

"Akshata Murthy is a citizen of India, the country of her birth and parents' home. India does not allow its citizens to hold the citizenship of another country simultaneously. So, according to British law, Ms Murthy is treated as non-domiciled for UK tax purposes. She has always and will continue to pay UK taxes on all her UK income."Spokesperson for Akshata Murthy

By Extension, the Controversy Around Rishi Sunak

If the whole outcry is regarding his wife using the UK's non-dom law to her advantage, where does Rishi Sunak fit in?

Well, Sunak has been criticised for being responsible for the high taxes that the British people have been paying (taxes are going to get higher).

This has happened in the backdrop of a serious cost-of-living crisis, and widening economic inequality in British society.

The Chancellor of the Exchequer has passionately defended his wife.

"To smear my wife to get at me is awful. She loves her country like I love mine," Sunak asserted in response to accusations regarding hypocrisy and tax avoidance.

Now there are two issues here. Both are exemplified by the concerns voiced by members of Sunak's own party, the Conservative Party, as reported by The Guardian:

"There's this guy, as rich as Croesus, putting up taxes when people are worrying about the next gas bill."Anonymous Conservative MP

"The perception is [an attitude of] 'what is the problem?' Here is someone worth £3 billion who has a different tax arrangement. I’m sure everything is above board but that’s not the point."Anonymous Conservative MP

Even if Murthy is not breaking any tax laws (and there is no evidence for the same at the moment), one problem that Sunak faces is that he has been raising taxes for ordinary British people.

So on one hand, commoners pay more tax, but his millionaire wife avoids paying millions in tax.

So, the second issue concerns the system, a system which has one rule for commoners, and another for the elite.

To add to that, tax experts, when asked about the current row, have clearly stated that Murthy's non-dom status is a product of her choice, not anyone's coercion.

Richard Murphy, a professor of accounting at Sheffield University management school and tax justice campaigner, confirmed the same to The Guardian.

"In that case the implication in Ms Murty’s statement that she has to be treated as non-domiciled is simply wrong. She is only non-domiciled because she asked to be so."

Labour Turns up the Heat

The party in Opposition, the Labour Party, has come out all guns blazing.

The shadow financial secretary to the Treasury, citing the "integrity of tax policy," has argued that it is "in the vital public interest" that Sunak provide clarity on whether he himself has benefited from his wife's non-dom status.

"As chancellor it is crucial you both follow the rules and lead by example. Any impression that there is one set of rules favouring a few, and another for everyone else, threatens the integrity of tax policy in our country," James Murray said, as reported by the BBC.

He also wrote a letter to Sunak (attached in the slideshow below), asking him 12 questions regarding the controversy.

Leader of the Labour Party and Leader of the Opposition Sir Keir Starmer has also spoken out, claiming that Sunak will have "very serious questions to answer".

"If it now transpires that his wife has used schemes to reduce her tax, while he's been increasing taxes on working people, that's breathtaking hypocrisy," he said, reported the BBC.

Since the revelations, Starmer has also been tweeting ferociously about the economic crisis in the country.

Additionally, the Liberal Democrats have urged Sunak to ensure that partners of ministers are barred from attaining non-dom status.

Sunak, however, may find some respite in what Business Secretary Kwasi Kwarteng has said while defending him and Murthy.

Kwarteng said it was "completely unfair" to criticise the tax practices of Murthy, "who is not a politician" and rejected claims made by the opposition that she is being sheltered by the Tory government.

Nevertheless, Sunak should expect a barrage of questions directed at him during next week's PMQs.

(At The Quint, we question everything. Play an active role in shaping our journalism by becoming a member today.)