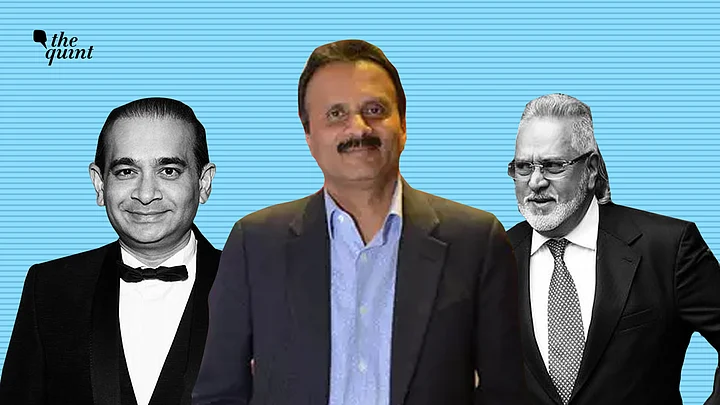

The pathos-filled letter and confirmed death, apparently by suicide, of Cafe Coffee Day founder VG Siddhartha, prompted Vijay Mallya, facing possible extradition back to India to tweet that “The Govt agencies and Banks can drive anyone to despair…Vicious and unrelenting.”

The message intended was clear, reiterating the buzz, that under the NDA government, Indian tax authorities, the Enforcement Authorities, and others such as the Serious Fraud Investigation Office – although never known for their velvet touch – have been markedly more dogged, unfair and politicised.

The right to a fair trial includes the right to a fair investigation, and the guarantee of a fair trial is a criterion to allow extradition to countries. This criterion is particularly emphasised by European signatories to the European Convention on Human Rights, including the United Kingdom.

The European Court of Human Rights (ECtHR) has held in a landmark case – reiterated in the magistrate’s decision to extradite Mr. Mallya – that a “flagrant denial of justice” would violate the right to a fair trial, and rule out extradition. Vijay Mallya has raised as a defence the lack of a fair trial in India, but this was rejected by the magistrate’s court, and the appellate court has not accepted the appeal on this ground of a lack of a fair trial or lack of a fair investigation.

Therefore, this route out is not longer an open for Mallya. Mallya’s objections to extradition included objections to conditions in prison, medical facilities, and judicial independence, but did not strongly take a position on the the lack of a fair investigation or the risk of attachment and seizure of properties by the investigative agencies during investigation. If he had, he may have had a point.

Raids Being Conducted Without Judicial Review

The courts are being strained to adjudicate on pleas of arbitrary and often draconian overreach by the agencies during investigation. Agencies in the past two decades have once again acquired wide reaching power to determine whether properties should be seized during investigation, and these are being, more often and not, misused.

It will be worth remembering that the allegations against Mr. Siddhartha, which have been unfortunately publicised by the Income tax authorities, were just that.

Where raids should only be conducted on a reasonable basis to suspect illegalities, they are being conducted without judicial scrutiny or even judicial review with impunity. Movable and immovable properties are being subjected to attachments arbitrarily.

I would wager that the percentage of administrative decisions to seize properties that are finally confirmed after trial would be shocking low. It was such a seizure, that, according to Mr. Siddhartha’s letter, resulted in a liquidity crunch and aborted a sale to an investor with much needed injection of liquidity.

It will be worth remembering that the allegations against Mr. Siddhartha, which have been unfortunately publicised by the Income tax authorities, were just that. They were pending adjudication by a court, and a final determination. Due process and the presumption of innocence not only required the impending trial be fair, but also callled for Siddhartha’s liberty, ability to carry on his trade, and present a defence. The tax authorites were required to act fairly and objectively. It seems, at least based on their disclosures since his death, that they didn’t.

A fair investigation is essential to the rule of law. The rule of law allows businessmen like Siddhartha to invest and take capital risks with some degree of regulatory certainty. For instance, evidence acquired through torture cannot be relied upon for extradition, even if there is no doctrine of excluding evidence improperly obtained evidence in India.

Due process is not an inconvenience to the efficiency of findings of guilt for those charged, but important protections for investors as well as the people at large. There is a fine line between letting people get away, and punishing the innocent or those whose businesses have simply failed, due to any reason, including error. It places too high a price for investors – a risk to their personal liberty, as well as the acceptable risk of their capital.

Too Much Discretion to Determine Prima Facie Guilt

In India v. Singh, the Canadian courts allowed extradition in cases where those who claimed that they were tortured to give evidence, failed to prove their assertions.

It was established as principle that statements taken illegally could not be used to establish a case for arbitration. The regulatory agencies have far too much discretion to determine prima facie guilt, based on witness statement that often do not stand up in court.

It is likely that such pleas of harassment, although likely foreclosed to Mallya in a court of law, will be taken by others fighting arbitration, including perhaps Nirav Modi.

It is these statements that lead to pre-trial adjudication and attachment of properties. The judicial review of these actions is a process that often rewinds only the most stark of injustices. Courts cannot be expected, even when acting effectively and judicially, to restrain agencies that are operating too far outside the margins of fairness.

The transgressions can only be controlled when they are anomaly, not when they are systematic. The British courts have recognised the independence and competence of the Indian judiciary, particularly the higher courts, but have yet to rule on whether the investigation itself may be too violative of rights to be carried forward. It is likely that such pleas of harassment, although likely foreclosed to Mallya in a court of law, will be taken by others fighting arbitration, including perhaps Nirav Modi.

The use of administrative agencies to target certain investors is certainly not a new practice. One may recall the targeting, through raids and other means, of the investors in Tehelka when its investigations ruffled feathers in Delhi.

However, India’s economy has evolved to much higher planes since then, and if the government’s goal of a 5 trillion economy is serious, then the costs induced by regulatory mechanism will have to be reduced. The issue isn’t one solely of human rights, but also investors looking at ensuring that their capital isn’t subjected to attachment without due process.

(Avi Singh is an advocate who specialises in transnational law and serves as the Additional Standing Counsel for the government of NCT of Delhi. This is an opinion piece and the views expressed are the author’s own. The Quint neither endorses nor is responsible for them.)

(The Quint will no longer be on WhatsApp, owing to changes in its policies regarding news publishers. You can now get the latest news updates on our Telegram channel. For handpicked stories every day, subscribe to us on Telegram.)