Seemingly unconnected headlines over the past week should give India's economy watchers fresh room for concern. Inflation, like Alladin's genie, is difficult to put back into the bottle — and it doesn't help when the government goes about it with the assumption that most of the answers to the problem lie at the Ballard Estate in Mumbai, the headquarters of the Reserve Bank of India(RBI), and not the North Block, where the finance minister sits.

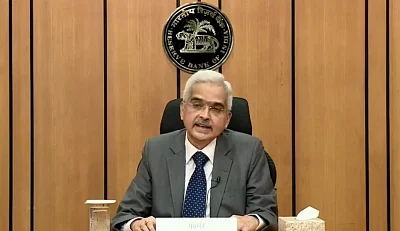

Speaking at the latest Monetary Policy Committee, RBI governor Shaktikanta Das admitted to the current challenges of a clouded outlook caused by the International financial markets and local weather conditions. Retail inflation hit a 5-month high of 7.41% in September, stubbornly above the RBI's upper tolerance limit of 6% while politically-sensitive food inflation was 8.6% — even higher than the 7.62% in August.

This leaves the RBI with no option but to increase interest rates further. Now imagine a situation where middle-class home loan and vehicle loan EMIs go up, even as the poorer sections fret about increasing prices of food items that in turn erode their disposable incomes and thus the demand for industrial goods

Interest Hikes Amid Hunger Pangs

India's rank on the Global Hunger Index(GHI) went down to 107 from 101 in 2021 last week out of 123 countries surveyed by two European NGOs—Concern Worldwide and Welthungerhilfe.

Predictably, the NDA government called this 'misinformation' and questioned its methodology and intent. Whatever the detail, in the context of a surge in food inflation, it should be a matter of concern for any decent administrator and perhaps more to the BJP than any other political party because I have held that the lower middle class is a traditional BJP vote base, one that is more vulnerable to inflation pressures than to unemployment.

While food inflation is up, buffer stocks of food grains, which had once caught the eyes of the Supreme Court because they were overflowing, are down again to barely above acceptable levels.

The government's vulnerability to playing the market to cool down food prices by intervention has, thus, come down. Wheat and rice stocks with state agencies are at five-year lows even as retail cereal price inflation has surged to a 105-month high of 11.5% in September.

India Needs To Have a Robust Inflation Management Plan

So what has the government in New Delhi done to check all this? Precious little.

It seems when Prime Minister Narendra Modi spoke about 'Sabka Saath, Sabka Vikas, Sabka Prayas' (Everybody's support, everybody's development, everybody's effort) we didn't realise that the poor would also bear the burden of muscular development (Think highways, ports, airports, data centres etc.)

Goods and Services Tax (GST) slapped on a slew of everyday food items can be seen cynically as a backdoor method to imposing a "Sabka Saath" tag on vulnerable sections. Even packaged parathas are confirmed to carry 18% GST, inviting political criticism and social media outrage.

Finance Minister Nirmala Sitharaman has indeed spoken of the need for fiscal measures to check inflation. It is equally true that since the Covid-19 pandemic outbreak, the government has helped poor farmers with direct income transfers and food grain supplies for the poor. But now is the time for a more business-as-usual approach to inflation management, rather than emergency measures. The past is past.

Let's look at a few basics. The economist's idea of inflation is just a number. The average citizen experiences it as a lifestyle or livelihood stress.

The Reserve Bank's elbow room is limited especially because factors such as the Ukraine war, oil output managed by the Organisation of Petroleum Exporting Countries (OPEC), and the US Fed's monetary policy are out of its control. All these are playing out with no sign of light at the end of the tunnel.

How Dollar’s Stronghold Affect In-House Budgets

The RBI has already spent more than $100 billion in defending the rupee against the US dollar which has surged because of a rise in US interest rates triggered by Fed's attempt to quell inflation at home. India's foreign exchange reserves are down and so are the food stocks.

The rupee is not weakening but the US dollar is strengthening, says the finance minister. Can that technical truth ease household budget pressures when imported raw materials turn costlier and in turn push up domestic prices? The rupee has fallen by about 9.8% over the past year against the hard currency.

India’s Fiscal Policy Demands a Reboot

Speaking in Washington, Mrs. Sithraman eloquently defended the government's LPG subsidy burden as something that helps sustainable development goals and called for a practical approach to subsidy policies. But she has to really walk the talk on several fiscal measures to check inflation. This could involve revisiting GST on a number of items, cutting back on muscular spending such as plush railway stations or high-speed trains or simply staggering some of its expenses to ease demand pressures in the economy.

A windfall tax already imposed on oil companies is acceptable in its efforts to plug fiscal gaps, but there is no going away from finding ways to ease the GST pressure or staggering some ambitious spending plans. A gentle look at what has happened in the UK might also help. Taxing the rich is not a bad idea, especially if executed meticulously.

It is basic macroeconomics that the Goldilocks periods combining high growth and low inflation are rare. Forcing the pace of growth while tolerating high inflation is not what the doctor ordered for India. It is time for the North Block to do some of the stuff that has so far been largely left to the tender shoulders of the RBI governor coping with a global maelstrom.

(The writer is a senior journalist and commentator who has worked for Reuters, Economic Times, Business Standard, and Hindustan Times. He can be reached on Twitter @madversity. This is an opinion article and the views expressed are the author's own. The Quint neither endorses nor is responsible for them.)