Ever since the ‘Electoral Bond’ was announced by Finance Minister Jaitley as his biggest contribution to “transparent electoral funding” in the 2017 budget, civil activists have been pointing out that it has taken their demand for transparency to an extreme mirror image, to total opacity.

While the government’s argument is that the electoral bond will ensure that only money from legal sources is funneled into the political parties, its opponents have argued that it completely and totally hides the identity of the donor from all public scrutiny and therefore the quid pro quo that is usually observed when a political party comes to power cannot be established openly.

Perhaps the FM worked out this scheme to get away from the crony capitalism charge his govt has been facing from Day 1.

So how does the “electoral bond” work and how does it protect the identity of the donor?

Is it really protected or does the government (and no one else) know the donation flow so that the government of the day can fine-tune its behaviour towards the donors to opposition parties (again a charge levied against the present BJP govt which at various times and by various people has been called the most “vindictive” ruling regime of any India has seen in past 70 years).

What does the bond look like and what is the experience of purchasing a bond?

As someone deeply interested in transparent and open public donations myself, I was curious to find out about these questions myself. I had missed the first “electoral bond window’ (1 March-10 March) but decided to purchase an electoral bond for myself this time and share my experiences with the public at large.

So, yesterday, I went out to the SBI Main branch at Parliament street and invested close to 3 hours of my time and consumed 3 hours of 2 bank officers and perhaps another 30 minutes of an AGM (admin) before I could lay my hands on my first “electoral bond”, a promissory note of a full Rs. 1000/- (if we calculate the total man hours taken up by this exercise, the bank lost approx. Rs 2000 according to my calculations. And don’t ask about my lost opportunity cost!!)

What Is An Electoral Bond?

Rather than explain in detail (since the point of the article is to share the purchase experience and transparency workflow) let me point you to the excellent Electoral Bond FAQ created by the SBI folks on the scheme.

This 15-page document provides all the information, process for purchase and even forms etc. Of course the officers at the bank will ask for more, that’s why you should read my story till the end.

So, as per this FAQ, I, as an individual buyer had two choices to purchase an electoral bond:

- Visit the bank, fill in the pay-in slip, give my cheque, hand over my KYC docs and wait 3 days for the cheque to be cleared. Then visit the bank again, do some more formalities and take home my bond.

- Make an online payment (via https://www.onlinesbi.com/) by first registering as a prospective buyer, generating a virtual a/c to transfer the funds, making a NEFT transfer, print a receipt (after 3 hours) and visit the bank with my receipt, KYC docs to complete the purchase.

Clearly, the offiline route was too tedious and meant two visits (or more) to the SBI Main branch from Gurgaon, which I very much wanted to avoid.

Also, since I decided to do this experiment on 7 April (egged on by a conversation on the so-called anonymity of the bond) I had precisely two working days (9 April & 10 April) to pull off my project. So online payment was the ONLY option for me, and I was thankful for that option.

Online Purchase Process

The online purchase process is relatively smooth. There are a few insights/tricks that may help some folks, so let me share the same.

- Step 1: Visit https://www.onlinesbi.com/

- Step 2: Click on the “Electoral Bond (new) menu” at the top menu bar

If you do this today, you will only see the ‘Information/Downloads’ option as the window for bond issue is now closed. Will re-open on July 1)

If the bond issue window is open, you will see a ‘Purchase/Redeem’ option and also a ‘Print Receipt’ option.

- Step 3: Select the Purchase/Redeem Option

- Step 4: Choose your state, preferred SBI branch (I tried Gurgaon and the branch option it gave me was Chandigarh. You don’t want to go to Chandigarh to buy a 1000 buck bond!)

- Step 5: Choose your denomination (1000 x 1)

- Step 6: Enter your mobile number, which will be authenticated through OTP. The OTP may not come instantly. If it doesn’t come in a minute. You can click on the re-send, which sent me the OTP twice!

- Step 7: The online SBI tool generates your application number (EBxxxxxxxx format). This number is crucial because the receipt generation is tied to this. Please note it down immediately. The number is NOT shown on the next screen, which is the challan/virtual account details to remit the funds via NEFT/RTGS.

- Step 8: Print the challan/virtual account details. It has the bank xfr instructions that you will need for the online banking you use.

Register the payee through net-banking and transfer the funds. I sent Rs. 1000 from my HDFC bank. I printed the transaction receipt from HDFC.

Never know what they may ask for, right?)

- Step 9: Three hours after the remittance, visit the online SBI site again. Choose the “Print Receipt” option (if the bond window is open) and enter the application serial number (from Step 7) and your phone number. Verify OTP and voila! your payment receipt for the electoral bond is presented. Print it (I printed 2 copies!)

- Step 10: Fill out the electoral bond application form. Its fairly straightforward to fill out. Sign it. Keep a copy of your PAN, Voter-ID/Passport and Aadhaar and you are ready to visit the Bank. Wait, you need another critical document that the FAQ doesn’t mention. But I will let you read on.

SBI Main Branch Visit

The SBI Main branch is located on Parliament street at the Jantar Mantar intersection. Get to the main building and you see a poster indicating that Electoral bond section is on the 5th floor. Take the lift to the 5th floor and ask for Mr Rawat (he is the officer handling this department). He also has a colleague Mr Anup.

I reached at 2:20 pm which happens to be the lunch time (wasn’t mentioned on the FAQ). So I had to wait till 3:00 for the lunch time to be over.

Mr Rawat took my papers, checked them out and first asked for my “original Aadhaar card”. I told him there is no concept of Aadhaar Card since Aadhaar is just a number to be used to verify my identity and he should not be storing my aadhaar or asking for my aadhaar number copy. He smiled. Rules are rules and ignorance can’t be tackled. Luckily, I had a print of my Aadhaar number allocation. And my biometric worked!

Next up, he wanted my PAN card. I forgot to take a copy but had the original with me. He was kind enough to use the office facilities to copy. And a smaller copy of my Voter ID. All done. Self attested. All done. I thought this was over and done/dusted. It had taken about 1.5 hours (the Java software was down on his system and therefore my Aadhaar could not be verified as the scanner would not connect). Teething troubles.

I was actually feeling happy so far. Then the next demand hit me. Anup said he needed a letter from my bank that the NEFT had been made from my account. I showed him the bank transaction report, a/c no, ref number and tried to reason that being a bank SBI has the mechanism to verify the sender bank has the same number. He insisted that this letter is a must to establish source of funds.

Now I was feeling as if I was doing some criminal act. These banks gave 20,000 cr loan to Nirav Modi on forges LOUs and were making me dance hoops for buying a Rs 1000 bond? Why was there so much distrust on purchasing a bond? Cant a bank verify which account has used NEFT ? How come they issued a receipt without any verification?

The FAQ does mention a bank letter but only in the case of DD from a bank. Why would someone doing online transaction then visit his branch to get that letter? I was getting frustrated. At this point Mr Joshi explained that SBI has been asked to verify “source of funds” and that’s why the letter? So I proposed if I can print a statement from my online banking to show the transaction was genuine – this was accepted and I was able to get the bond issued after 2 hours! Kudos to Mr Joshi!

Note: The missing doc mentioned in the FAQ/Online transaction process is the letter from the bank. If you don’t wish to make a visit to the branch (who does nowadays), please print a statement page showing the NEFT for electoral bond purchase. That may work or may not , depending on the officer in-charge. My team was dealing with an online bond purchase case for the first time, clearly. Oh and they will make you fill out a pay-in slip, anyway, paper matters you know.

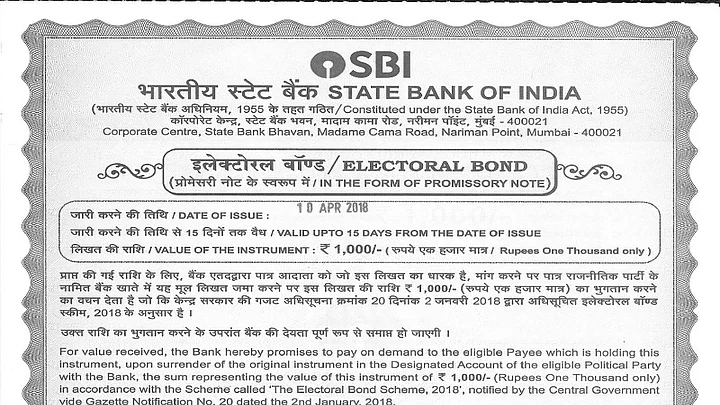

The BOND

The bond is a normal-looking bond with some clear security features. It has SBI water-mark, the govt seal watermark and other security features common in currency notes and promissory notes. Clearly the government/SBI has gone deep to create a secure paper instrument that may not be easy to copy.

The bond has a blue coloured overlay print that grabs attention. This suggests to the curious mind that there is some pattern underneath. A deep scan did not reveal anything.

The key aspect to offer anonymity is that the bond has no serial number or buyer details. Since the bond is a common denomination, when redeemed it would be impossible for the party to co-relate which bond was given by which donor. Also, within SBI itself, the issuing team is different from the redemption team, I am told. So the knowledge probably isn’t even easily available to SBI officers.

But is the bond truly secure without any serial number of signature? How does SBI authorise the bond at the time of redemption? How does the SBI know how many bonds have been issued? In all respects the bond is equivalent to a currency note, except it can be redeemed only by a political party, so there must be a way to keep track of number of bonds issues (just like serial numbers on currency notes). Without serial numbers, could anyone print fake bonds and make hay?

A visual inspection, under a magnifier does not reveal any printed serial number or hidden numbers on the bond. Clearly, any steganography on the bonds is within the patterns printed on the bond itself (the patterns reminded me of the DNA steganography theories). An article in The Quint today provides the answer – the serial number is visible under ultra-violet light and embedded on the right hand top corner. But is this a donor tracker number or just a running serial number to track number of bonds issued?

So, here is how I think the bond verification and redemption will work. When the bond is presented, a scanner looks at the pattern that would signal a valid bond/invalid bond (like a fake note). If the bond is valid, the officers check the serial number to ensure it was validly issued by SBI. They then look at the value (each series has a pre-printed value) and the value is credited to the depositors account. It is not clear if the officers KNOW who the serial number was issued to and therefore the anonymity of the donor is maintained at the processing level.

The challenge is at the higher levels of the bank, finance ministry and government. If a serial number is being maintained (as validated by The Quint) then clearly it would be possible to track all donors at the “interested” level. This certainly seems to break the government’s stated position that the bonds will be anonymous. I will be doing the UV test myself to confirm this. More on this later.

Challenges/Open Questions

1. Suppose I give the bond to a friend to deposit to his favorite party, will the party issue a receipt to the bearer? But he did not make any legal donation. So won’t the party be in the dock for an illegal receipt and for issuing a tax deductible certificate to a fake donor? The tax authorities would also be facing significant challenges in verifying the tax claims cause they wont have access to the bond donor data. It’s getting complicated.

2. The political party is required to declare details of all donors (PAN etc) for any donation above Rs 20,000, donated in a financial year. How will the bond donors be validated if the political party has no way to verify who the actual donor was? This is worse than cash in some ways as the party could have hidden the cash donation but here may be forced to make a wrong declaration. The answer, most likely will be that the party has no obligation to report electoral bonds (yet to be verified).

3. I think the electoral bond/promissory note in the current form is akin to money laundering. Just like the Jan Dhan accounts were used by many to deposit cash and transfer out in new notes, one could deposit cash into multiple JD accounts, buy bonds using KYC of the poor unsuspecting people and aggregate the same into a party account. If the party has no obligation to report electoral bonds (as suspected earlier) our FM has simply replaced large unaccounted cash donations with large unaccounted bank routed bonds. No gain at all.

I will stop here and revisit this article once I have more visibility on the UV serial number, the redemption workflow (racing against time to get my favorite party to open approved bank account) and some more thoughts on bond authentication (steganography), fungibility (when you cant distinguish between two units of same commodity), identification (who bought it/holds it and such higher order abstraction.

(This article was first published on Medium. It has has been republished with permission)